Whatever your opinion, it is plain to see that New Zealand needs affordable new housing, and there are plenty of advantages to promoting an environment for new supply too. Recently, there has been a mentality shift as to the types of properties kiwis deem desirable. Gone are the days of your first home being a quarter acre section on the outskirts of the city, or a standalone home with a backyard on the city fringe within a good school zone. Personally, I am waiting for my 58m2, two-bedroom apartment to be completed sometime next year, at which point I will reside with 120 close neighbours... but hey, at least we share a pool.

It is this type of mentality shift that future generations of home buyers may need to embrace (or they at least live in London for a while before buying a home). Increasingly, it seems that small, stylish footprints offering creative space saving opportunities are what developers have to offer prospective buyers.

Benefits of buying new

In the current political landscape, the tax breaks on offer and low LVR restrictions for investors make new properties an attractive buy, and this is without factoring in the lower initial maintenance costs associated with a new build.

Often, buying a new build property off the plans means there is a significant amount of time between signing the Sales and Purchase agreement, paying your initial deposit (usually 10%), settling on the property, moving in, and of course drawing down the loan. In some instances, the purchaser could benefit from this time in the market through capital gains as they open the door upon completion. Although it is worth noting that these types of capital gains are not guaranteed as the market moves both ways.

Government new build initiatives

In addition to the tax breaks and LVR exemptions we have seen over the last year, two of NZ’s main bank lenders are taking advantage of a discounted funding line from the Reserve Bank and passing on that discount to purchasers of new build properties. Under this initiative, ASB was able to support over 4,300 new build property purchases within a year and will conclude their offering when the last approved properties settle out their lending.

Kiwibuild is another (highly criticised) initiative, started in 2018 to provide affordable homes for first home buyers and to begin to address the perceived housing crisis. The scheme was designed to address the challenges of entering the housing market by producing price capped new build properties (region specific) at a rate of 10,000 per year, or 100,000 by 2028. In comparison to the vision, completed builds as of mid 2021 had barely hit over 1,000 across the country.

Let’s flesh out some of these incentives and initiatives in a hypothetical scenario...

A deeper dive

Let’s say you are a first home buyer eligible to purchase a Kiwibuild property. You have secured your home start grant approval (another government initiative for first home buyers) and you are looking to buy a new build property. Because you are purchasing a new build, you have access to a higher purchase price cap on that property and you also have access to double the amount of grant funding towards your new home (assuming you meet the eligibility criteria).

If you are to buy in Auckland, you could then purchase a $700k new build property vs. $650k worth of existing housing stock. You are then entitled to $10k (per person) in grant funding, as opposed to $5k if you were purchasing a previously built property. In addition to this, if you go to apply for lending at ANZ, you have access to their Blueprint to Build Scheme, which offers a discounted variable rate for the first 2 years of your loan term, currently at 2.78%.

If that doesn’t sound like an incentive to purchase new, I'm not sure what does.

If we were to extend the scenario, let’s say in a years' time, you are keen to purchase your first investment property. You've done your own research, so you decide to purchase a new build property because you only need a 20% deposit (as opposed to 40%), and your interest expense is tax deductible for the first 20 years of that property's existence.

Sounds like a no brainer to me.

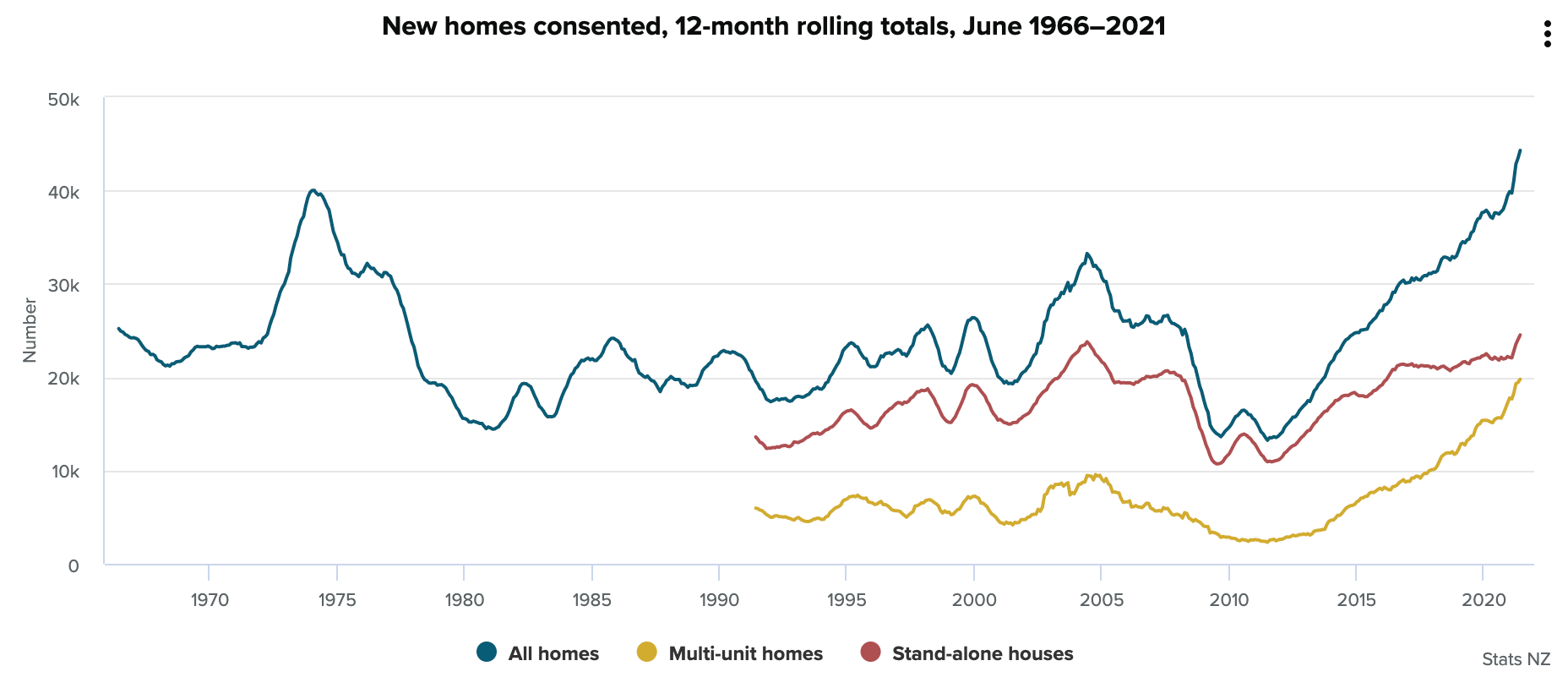

Now let's take a look at this graph below from Stats NZ, which illustrates the resurgence of consented new build properties up to year ended June 2021. This is the point where a new record of 44,299 new homes consented was reached, the most since the previous peak of 40,025 in February 1974.

A NZ Herald article that has been recently published announced that we have again broken the record for consents granted in a year, reaching over 50,000 for year end March 2022.

So, what does this all mean?

Seemingly, New Zealand has been primed for an injection of new housing to support demand and population growth, and to take the pressure off the ever-inflating prices of existing stock. At a high level, I believe the government initiatives and incentives in place are performing their function to a degree. However, there are broader issues at play, which ultimately mean that those 50,000 consents are unlikely to convert to 50,000 properties in the near future – another blog for another day.

Regardless, new build properties are the necessary and inevitable solution to New Zealand's housing shortage. Without a major population evacuation, there is no other way to support sustainable and affordable housing for prospective homeowners. So whether you're trading in the quarter acre section for a shared use pool, or re-evaluating your perspective on the size of your vegetable garden, it’s time we embrace urban density and get to know our neighbours a little better.

Want more information on how we can help you make the first step onto the property ladder? Get in touch.

Please read our Disclaimer Statement for more information.