Development offers can be tricky to unpack, lenders are often very clever at disguising how much they are charging through a multitude of different fees. Getting blinded by a low interest rate or simply adding up the total cost of funds does not often paint the most accurate picture.

Let’s take a deep dive into the different costs that might be seen in a development offer in NZ.

Standard Fees

- Interest Rate – The rate of interest that is charged on the amount of the loan that is drawn

- Line Fee – A per month fee that is normally charged on the facility limit. (In some cases, it is charged on the principal lending amount. i.e. a lender doesn’t charge fees on their own fees.)

- Establishment Fee – A fee that is normally charged on the facility limit that is capitalised to the loan and bears interest on day 1 of the facility.

- Work/Acceptance Fee – A fee that is charged upon signing of the indicative finance proposal for the lender to commence formal credit approval and produce loan documents. This is normally in the range of $2,000-$10,000 and is netted off the establishment fee, should the loan proceed. This is often refundable in the event the lender doesn’t provide a formal offer on equivalent terms to the indicative but can also be non-refundable.

- Legal Fees – If the lender outsources the legal work involved in producing the loan documents, these legal costs are often borne by the borrower. Lenders should always give you a quote (or two) from the law firm beforehand.

Want to learn more about the development finance process in general? Download our free comprehensive guide here.

Less common fees

- Travel/Accommodation Fee – This is sometimes charged by lenders to pay for their travel costs to complete regular site visits of the property. This could be around $10,000 each visit on a quarterly basis if the lender is coming from overseas.

- Loan Administration Fee – Some lenders charge a small monthly fee to manage the loan.

- Early repayment fee – This can come in different forms. Some lenders require the borrower to pay a minimum of 3 months interest if the loan is repaid prior. Other lenders may require 30 days’ notice to repay the loan or just a straight 1 months’ worth of interest cost for early repayment.

- Drawdown Fees – Some lenders may charge a small, fixed amount to process each drawdown.

Other details that can cause costs to increase is the drawdown process of different lenders. In rare cases, there can be lenders who only drawdown a facility in a few tranches or advance it entirely upfront without any progress drawdowns. This increases interest costs significantly as the utilisation rate rises.

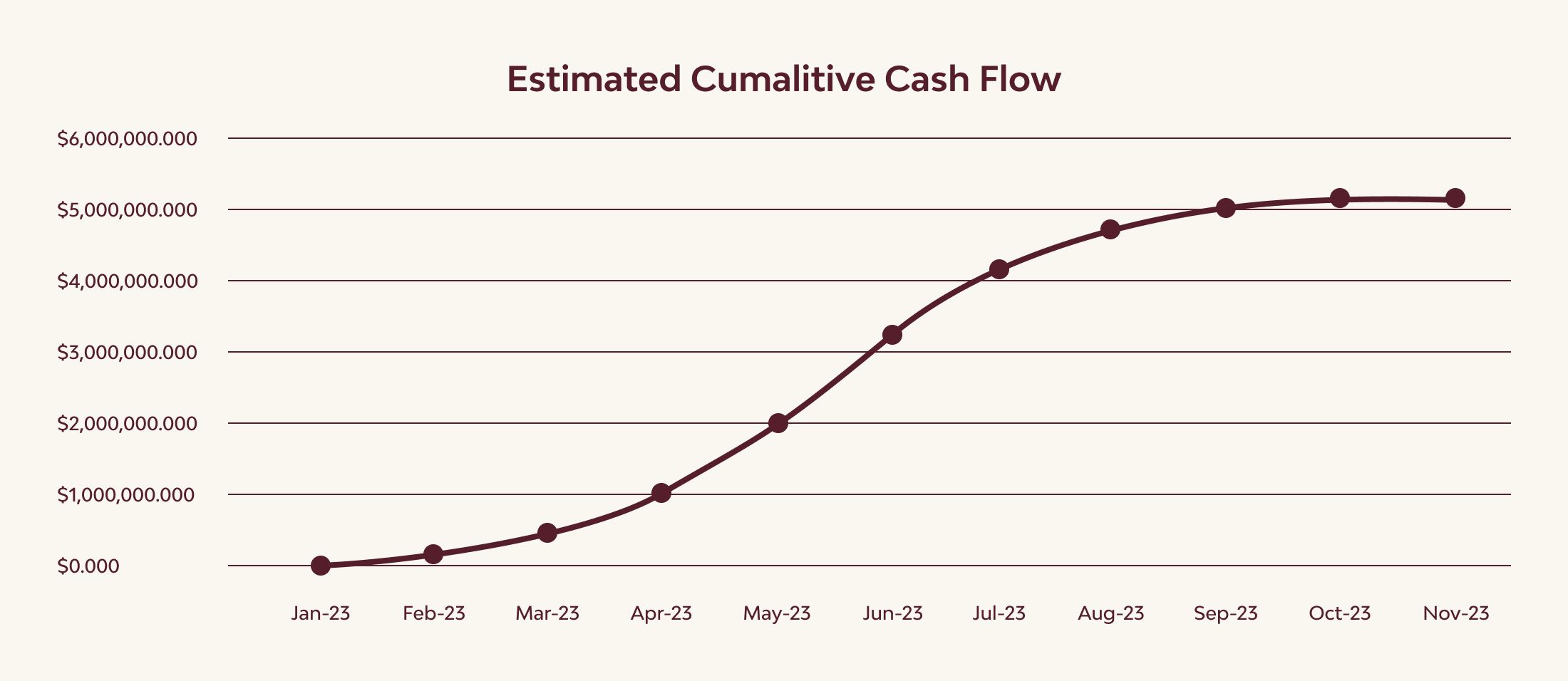

Expected Cash Flow

The nature of property development generally means costs are not drawn down in a linear fashion. In general, costs are concentrated towards the middle of the programme, typically peaking when the project is fully closed in and easing off towards the end of the programme when waiting on titles and CCC. This means the cumulative cash flow resembles an S-Curve as pictured in the example below.

For the purpose of feasibility studies, we assess the interest costs of a project at a utilisation rate of 65-70%. In other words, we anticipate that on average, the facility will be drawn to 65-70% of the total limit with interest only charged on this drawn portion (i.e. $6.5M of a $10M limit).

If the borrower has a significant portion of debt on the land that needs to be refinanced on initial drawdown, then this will increase the real utilisation rate as there will be an initial advance of funds.

Comparison

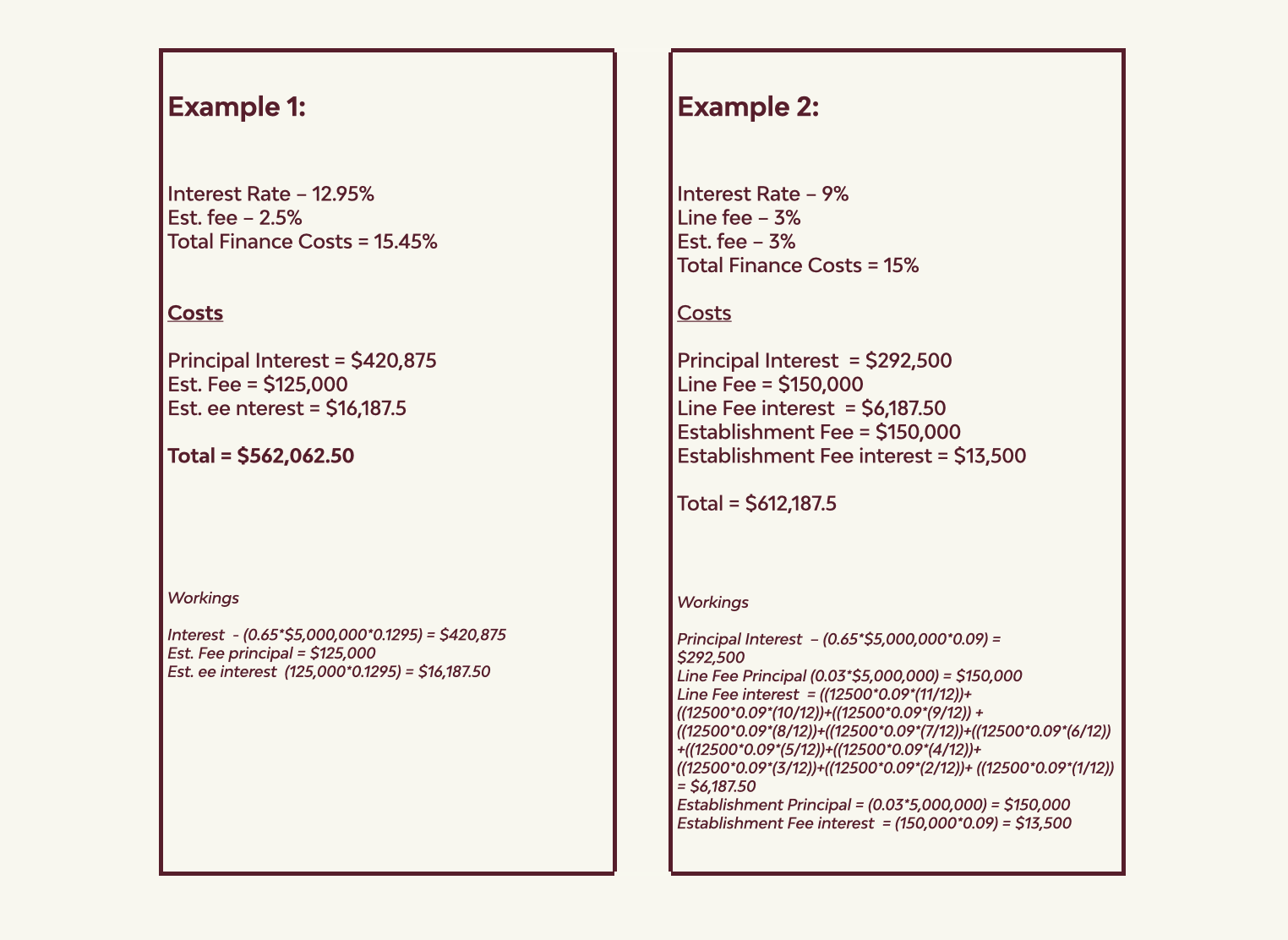

To use an example that is reflective of today’s market, I have modelled two different offers. One with a much higher interest rate that is often scoffed at on first view and the other with a line fee.

Assumptions

- Loan Limit - $5,000,000

- Utilisation rate – 65% (The average amount of the loan that is drawn)

- Term – 12 Months

- Land unencumbered – i.e. no debt to refinance on initial drawdown of the facility.

As you can see from the above comparison, the first example with a higher interest rate and total finance costs ends up cheaper due to the higher weighting of fees in the 2nd example. Fees work out more expensive as they are not charged on the amount drawn, but the loan limit. An establishment fee is proportionately more expensive than a line fee as it bears interest from day 1 as opposed to through the project.

Have questions around fees and how they may impact your development project? Get in touch with us here, we are happy to help!

Why do non-bank lenders charge high fees?

Firstly, non-bank lenders fit a profile in the market where they are taking on greater risk than other financiers (i.e. banks) and they therefore charge additional premiums to account for that additional risk.

This can also be indicative of the funding structure within the company. A number of non-bank lenders have high net worth private investors providing their equity capital with wholesale funding line(s) providing the balance. In this scenario, the cost of their debt is the weighted average of the investor charge on funds (normally set at the interest rate offered to borrowers) and the cost of the wholesale funding.

The balance is retained by the company.

Another benefit of this fee structure is that the initial costs can appear lower in comparison to others. Non-bank lenders will often publicly advertise their low rates to entice borrowers who, without a full understanding, may misread the total costs. A line fee for example is often quoted on a per month basis, appearing negligible on first view.

A high line fee may also be due to the slow drawdown rate of a facility. If the early months of the facility are to fund soft costs and the bulk of the facility doesn’t drawdown for an extended period the lender may decide to increase the line fee charged. After all a line fee is charged as the lender must hold unused funds in a facility and it ensures they get an adequate return on their capital allocation.

3 ways to reduce your interest costs

One way to keep your interest cost low is to manage the issuance of titles. LINZ can be slow to grant titles and if this is a final step in the development, it delays settlement, leaving your fully drawn facility bearing interest after practical completion. To achieve titles early, it can often be wise to complete the work required before you finish the build. This means installing utility connections and pouring driveway before rather than after the dwellings are up, allowing you to apply for titles early and have these prepared for completion. (It must be noted that pouring the driveway early comes with its own risks i.e. damage from heavy trucks during construction.)

Another costly delay can be from subcontractors not filing accurate paperwork required to apply for Code of Compliance. Staying on top of your sub-contractors to ensure they are producing the necessary statements, warranties and sign-offs along the way (rather than at the end of construction) can allow you to achieve CCC as early as possible.

Negotiating liquidating damages into the build contract is another way to hedge against further interest expense. LD’s are a daily sum that the builder must pay the developer for every day the build is not complete after the mutually agreed deadline. You can use these to offset the extra interest costs incurred in the event of delays, and they are a good tool to leverage your head contractor. Check out our Development Contracts Guide for further information.

To sum up

In summary, it is always important to dig a little deeper into any offer presented. Putting it in front of an experienced pair of eyes will help you grasp a more accurate picture of the overall costs involved. If you need help understanding further, get in touch with us here we’re happy to help!

Please read our Disclaimer Statement for more information.