Disclaimer – As of 18th of March 2022, ASB have announced that they will no longer be continuing their 'Back My Build' Scheme after 8th of April 2022 as they have met their lending capacity early for the scheme.

Getting onto the property ladder as a First Home Buyer or even upgrading your home can be a gruelling experience which almost seems impossible in today’s market. With the growing gap between incomes and house prices, along with ever changing bank lending rules, it can seem as if home buyers are continually being hamstrung out of purchasing a home.

Although there has been an exodus of lending assistance for home buyers (restricting of LVRs & the introduction of CCCFA), we have still seen quite a few finance enquiries for turnkey/newly developed residential properties. We believe this is because there is generally more supply on the market and they are a cheaper point of entry, meaning that the 20% deposit required for lending is more likely to be obtainable in comparison to the prices of a pre-existing home.

The benefit of purchasing a new build or turnkey property from a lending perspective, is that some of the major banks have developed schemes to assist borrowers purchasing these types of assets that have lower interest payments for the first few years of the loan.

The Back My Build scheme by ASB and the Blueprint To Build scheme by ANZ, are two of the available products that borrowers can take advantage of if they are in the market of buying or building a new home or investment property.

These respective schemes provide consumers with a generous interest rate discount towards that specific bank’s floating rate for either 2 (ANZ) or 3 (ASB) years. To be clear, this is a fixed discount off the floating rate, meaning if the floating rate rises, so does the overall rate. Further below.

The schemes were introduced after the release of the Reserve Banks Funding For Lending Programme, which was a tool for eligible banks to borrow funds directly from the Reserve Bank at the current Official Cash Rate (OCR) lowering banks overall funding costs, which can then be passed onto borrowers which ASB & ANZ have done.

So what are some of the pros and cons of these schemes? Let’s dive into it!

Pros

Lower interest costs

As mentioned above, the schemes offer consumers the opportunity to benefit from lower interest rate payments for the first 2 to 3 years of their loan. This means the rates that are offered from these schemes are the lowest rates currently available on offer by any bank! This relieves a significant amount of financial pressure on those financing property builds during the construction where you are bound by a floating rate.

ASB’s interest rate discount at the time of writing is a fixed 2.31% discount on their current 4.60% variable rate, giving an equivalent rate of 2.29% for 3 years.

ANZs interest rate discount at the time of writing is a fixed 2.76% discount on their current 4.80% variable rate, giving an equivalent rate of 2.04% for 2 years.

Convert current construction loan into the scheme

If you are currently in the process of building your own home or investment property/s through a construction loan which has not yet been fully drawn down on, you may have the opportunity to convert this loan into one of the schemes, meaning you could benefit from the lower rates (conditions may apply).

Flexibility to change from floating to fixed

Similarly to a normal home or construction loan, the schemes give you the flexibility to shift your loan from the floating discounted interest rate to a fixed rate at any time during the life of the loan. However, you need to be aware that you cannot shift it back once changed.

Eligibility for Homestar cash back

Both ANZ & ASB have partnered with the New Zealand Green Building Council to encourage consumers to build green & sustainable homes. If the borrower is able to evidence their new purchase or build will meet a 6 Homestar rated home or higher, then the respective bank will contribute either a $2,000 (ASB) or $3,000 (ANZ) cash reward. The loan must be kept with the respective bank for at least 3 years.

High LVR support

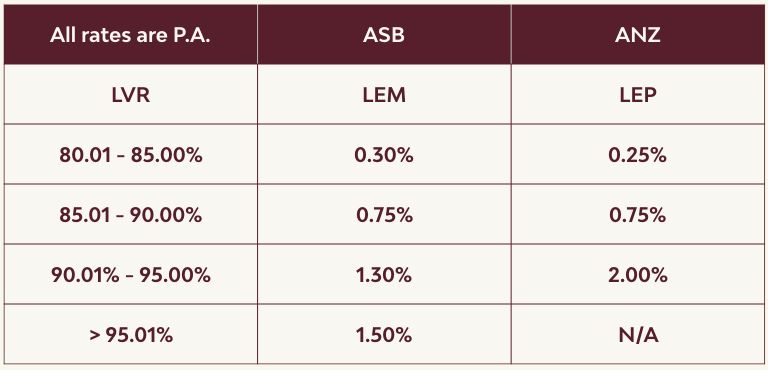

Both schemes support higher LVRs for home buyers, however these will be subject to LEM (Low Equity Margin) or LEP (Low Equity Premium).

The LEM from ASB & LEP from ANZ are the same fee product, just named differently by each bank. In summary, they are additional fees charged to you for having a higher LVR loan or lower equity loan.

At the time of writing this blog, there is currently a restriction on LVRs meaning that first home buyers are required to have no more than an 80% LVR, meaning the above is currently on hold for the schemes.

Cons

Floating Interest Rate

The essence of the schemes is that they are a discount on the floating rate, meaning that as the floating rate fluctuates, so will your interest payments. Although your payments are more vulnerable to a rate change, the likelihood that it will increase past the main bank’s fixed rates in the next 2 to 3 years while you benefit from the discount is unlikely.

Cannot be used to Purchase Land or for Renovating

If you are looking to build and plan to purchase land first, then unfortunately you cannot use these schemes to solely purchase land, although you can refinance your loan (after you have purchased the land) into one of the schemes to reap the benefits once you have the building plans in place.

You cannot refinance your loan if the loan is fully drawn down, so it is best to have a chat to your mortgage adviser sooner rather than later.

Neither scheme supports renovations.

No Cash Back

Unfortunately, cash back is only available to eligible FHBs and is not available for home buyers or investors in any form, apart from the $3,000 cash reward if you can meet a 6 Homestar as mentioned above.

Application Fees

Both banks generally require an application fee of either $400 (ASB), $500 or up to 1% of the loan amount (ANZ) although your mortgage adviser may be able to get these fees waived.

Not available to Developers/categorised into Commercial Division

The schemes are only available for new build homes or residential investment properties and are not available to developers who fall under a commercial bank division or for building commercial property. Land and package or turnkey properties are eligible under these schemes.

LEM (Low Equity Margin) & LEP (Low Equity Premium)

The LEM & LEP as mentioned above are a pro for those home buyers needing a lower equity loan, but are also a con for the fees a consumer incurs from having this type of loan (see above for fees chart).

The Back My Build & Blueprint To Build schemes are a great opportunity for both home buyers and investors to utilise and to assist them in the earlier stages of their build. It relieves a significant amount of financial pressure, and also gives a leg up to those smaller investors who require a higher LVR or lower deposit.

If this is something that you believe you could utilise as a home buyer or investor and would like to chat further, please feel free to get in touch with us here at Lateral Partners and we would be more than happy to talk you through it a bit further and/or assess your current situation to give you further advice.

Please read our Disclaimer Statement for more information.