Living in NZ is tough at the moment… Let’s be honest, NZ is not in a good spot with the cost-of-living crisis, low economic stimulation (NZ recession), and with high home loan interest rates it’s making it really hard for people to live their normal lives without some repercussion of financial stress or hardship.

Most of our conversations with clients currently surround their upcoming home loan refixes, what we think is going to happen with interest rates, and which bank offers the lowest home loan interest rate.

Most people are aware and conscious of the fact that home loan interest rates are high and are starting to feel the pinch of the higher interest rates as they move from lower 2, 3, or 4 percent interest rates to 6 or 7 percent interest rates, for most double or tripling their mortgage repayments.

They are conscious of the pressure their home loan interest rates are having on their financial position and are either looking for the bank offering the lowest home loan interest rates or are wanting to make a change whether that’s a restructure of their home loan, reduction in debt, or sale of an asset.

Who is offering the lowest home loan interest rates?

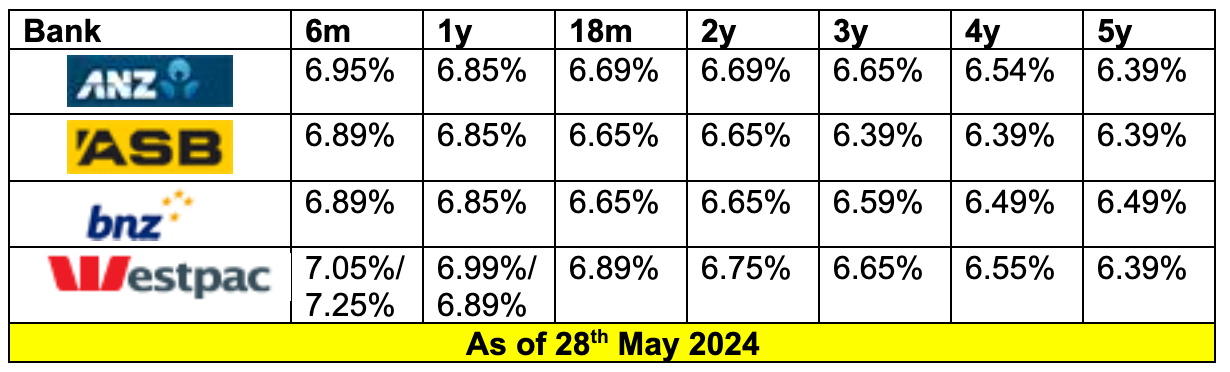

Currently most banks are much for muchness when it comes to their interest rate offerings and there is no outright leader in the market. However, interest rates can differ depending on the size of the lending, the LVR, and the different loan products offered by different banks.

Below is a chart summarising refix interest rates offered by the 4 main banks which have recently been offered to clients, noting that the exception is Westpac who unless you have a sizeable amount of lending with them (circa $1.5m+ as a guide but is case by case) will offer the higher of the interest rates noted below (6m & 1y).

Other notable interest rate mentions.

SBS Bank

- First Home Combo (Only for First Home Buyers) discount to their 1-year interest rate to 6.74% or 0.50% off their 1-year fixed rate,

- 2.55% discount to their floating interest rate (currently 8.74%) to those building their first home meaning an effective interest rate of 6.19% floating,

- a 3-year fixed rate of 5.99%,

- and their 4-year & 5-year fixed rates are being offered at 6.19% respectively

ANZ

- Have a product called the Blueprint To Build for customers building a first home or investment property, or customers buying a turnkey/off the plans first home or investment property.

This product provides the customer a discount of either 1.25% to ANZs Floating (8.64%) & Flexible (8.75%) or 0.60% off their Standard Fixed interest rates which is beneficial for those clients buying with less than 20% deposit.

What is going to happen with interest rates?

I premise this by stating that my opinion on interest rates are crystal ball visions, but are what I liked to think are informed crystal ball visions based on what is happening in the NZ economy, listening to different economists from different banks speak about their thoughts of the future of interest rates, and conversations we have had here at Lateral Partners. This is not personalised financial advice as different interest rates suit different people’s financial needs, goals, and affordability’s and you should always speak to your mortgage adviser to assist with advising appropriately in relation to your financial position.

4 key considerations

There are several factors which inform my opinion about when we will see interest rate decrease, but I have broken these down into what I believe are the 4 key considerations.

- CPI/Inflation. Changes in Inflation indicate to the market that the OCR is going to either increase or decrease in the future and therefore will inform the wholesale rates available to the banks flowing into their interest rates offered, or;

- OCR. Changes in the OCR, which the RBNZ controls and either increases or decreases this to control inflation or stimulate the economy, directly impacts home loan interest rates as the banks cost of borrowing from the RBNZ either increases or decreases.

- Cost of Living Crisis. As I am sure we are all aware by now NZ has had a cost-of-living crisis which started developing when inflation started running away at the end of 2021, but really started hitting homes in mid 2022. See graph from Stats NZ Stats NZ Cost Of Living Crisis.

Note, we are referring to the ongoing cost of living issue for New Zealanders rather than continued inflation. It is a reference to the predicament NZ Households are facing in managing their expenses. - NZ Recession. As of the 21st March 2024 NZ was officially announced to be in a recession.

Working with these I have surmised below how they each inform my opinion.

CPI/Inflation

CPI (Consumer Price Index) is the measure of the prices of goods and services that NZ households buy, and growth here provides a measure of household inflation e.g. how much these prices are increasing year on year.

Over the past 24 months we have seen year on year CPI/Inflation slowly decreasing as the RBNZ holds the OCR high to combat the rapid increase to Inflation during the 2021 & 2022 years.

The RBNZs goal is to get Inflation within 1-3% and as of the 17th April 2024 inflation is sitting at 4%, a welcome decrease from 4.7% in the previous quarter, but still higher than what the RBNZ were hoping for at 3.8%, reflecting that inflation could be a bit stickier to get under control than they hoped for.

The expectation would be that once inflation gets within this 1-3% target range we will see some easing on the OCR and in turn home loan interest rates, but when will we get there is the next question.

It is also worth noting that this is a year-on-year measure of inflation and therefore a reflection of the increase on prices from 12 months ago. Astute readers will note prices went up well before then and this is therefore inflation on already inflated prices.

OCR

Since October 2021 until May 2023 the RBNZ consistently increased the OCR as inflation continued to run out of control attempting to reign it in. The OCR capped out at 5.5% which it has remained at for the past 12 months.

The increase in the OCR over this period was 5.25%, the most aggressive hike in living memory.

In turn the average 1 year home loan interest rates across the banks rose by 4.36% (Oct 21 until today) Interest.co.nz Average 1 Year Fixed Home Loan Interest Rate.

Until inflation is well under control the expectation is that we will not see the OCR reduced. Given that inflation appears to be stickier than first thought this could be a longer time that initially estimated.

Cost Of Living Crisis

The way Stats NZ have been measuring the Cost Of Living is through the Household Living-Costs Price Indexes (HLPIs) which measures how inflation affects households.

This measurement closely follows the trend of inflation, so as inflation increases so does the HLPI/cost of living and as it decreases so does the cost of living.

As of Dec 23 (latest HLPI data) inflation had cooled off to 4.7% from 5.6% whereas the cost-of-living inflation still remained high at 7%, which reflects inflation still needs to come back quite a bit before we see some relief in the cost of living.

The other thing to note is that although year on year inflation has come back, this does not mean that the price of goods and services will come back to the levels they were 2020/2021 unless NZ went through a disinflation cycle (inflation below 0% with price drops across goods and services – note, it is very rare that we see falling prices of goods for any prolonged period).

In a nutshell, the cost of living is going to persist for a long time until either, 1) Inflation comes back, 2) incomes catch up to the new NZ economic pricing.

NZ Recession

A recession is when an economy experiences 2 consecutive quarters of negative growth to GDP (Gross Domestic Product; measure of the value of goods and services in an economy). A healthy growth target for GDP and what the RBNZ trys to maintain is between 2-3%.

For the past 2 quarters NZ GDP shrunk by -0.3% & -0.1% triggering NZ to be in a recessionary period.

The RBNZ can use the OCR to stimulate the economy by decreasing OCR and in turn home loan interest rates and other borrowing interest rates which will encourage consumers to spend and stimulate economic activity, but it also drives inflation as people start to spend money and prices normally rise.

Crystal ball visions

In saying all of that, I think the main things the RBNZ are going to have to monitor and consider closely are,

- Getting inflation under control, which they have made clear is their number 1 priority currently. The sooner they can get this in check the better off the NZ economy and NZ population will be.

- Cost Of Living Crisis. The RBNZ is currently stuck between a rock and a hard place, between controlling inflation and the cost-of-living crisis.

If inflation isn’t getting closer to their 1-3% target band come the next quarters announcement (17th July 2024) which could happen if inflation is sticky, then the RBNZ will need to make a choice. Keep chasing inflation by holding or increasing the OCR or be the “good guys” and start decreasing or planning to decrease OCR to relieve a bit of pressure on NZ households. The big kicker here is that just over 1/3 of all NZ mortgages are coming up for refix by July 2024 which could cause more stress for those coming off those low fixed interest rates experienced a few years ago. - NZ Recession. If the statistics keep coming out that GDP growth is in the negatives, then this is going to be a red flag to the RBNZ who will need to watch this closely as well.

A recession causes lower demand for goods and services, can cause businesses to begin to fail, which in turn causes higher unemployment, unemployed people then need to cut their budgets which further lower demands for goods and services within the economy, and so a cycle begins, something the RBNZ will want to avoid or in the worst cases of recessions economies have collapsed.

Unemployment, whilst ignored when considering the OCR, could become a political driver for the RBNZ pushing downward on the OCR.

An increase in OCR would cause more pain and hurt and I just don’t think the RBNZ/Adrian Orr have the guts to put New Zealanders and the NZ economy into more pain and hurt, although this is the right thing to do to correct inflation, prices, and the cost of living in the economy.

To combat the Cost Of Living Crisis & NZ recession, the RBNZ can use decreases in the OCR to stimulate an economy by making money cheaper to borrow and in turn consumers will have more money to spend and cause GDP to grow, but as mentioned above this is an inflationary activity. It is a massive balancing act that the RBNZ needs to control very delicately.

I believe that in the next 6 to 12 months we will see some OCR decreases likely small drops (-0.25%) rather than anything bigger (-0.50% or -1.00%) and in turn decrease the banks home loan interest rates, as inflation comes back to a suitable level, but also to relieve some pressure on both the Cost Of Living & NZ Recession especially if this continues to persist or get worse.

The introduction to Debt-to-Income Ratios (DTI’s) is also an interesting consideration as this should allow interest rates to be reduced without adding too much fuel to home prices as leverage against homes remains constrained to income. This could be part of the wider RBNZ strategy, although that is speculation.

What should I do if I am feeling the pinch of my home loan interest rates?

Speak to your Mortgage Adviser! Yes, I am biased in saying this as this is my profession, but you speak to your doctor when you’re sick, your builder when you want to construction a new home or renovate a property, so why wouldn’t you speak to a Mortgage Adviser (who shouldn’t cost you anything) about your home loan?

Mortgage Advisers work with all types of home loan situations day in and day out, all the banks and other similar lenders and therefore can give you information on different home loan products which may suit your needs, and you can rest assured you are getting the best and most professional advice in relation to your home loan.

If you have any questions or need advise, reach out!

Please read our Disclaimer Statement for more information.