Well, that was a good old rollercoaster of an election. It had looked like a forgone conclusion for much of this year that National / Act were a given for the win but in the lead up to the election the polls seemed to start to swing the other way only for the election night to put paid to the accuracy of those. Winston still seems to have a say though….

Much of the talk has been that National will get us ‘back on track’ and we will see an economic boom, treasury surpluses, higher house prices and a welcome togetherness of us all. Will that be the case?

Those who have read some of my previous more opinionated pieces probably know that I lean more right than left. I do share the view that we needed a change as a nation and the hope that we will see some more fiscal austerity under a new government. I do not, however, think that we are going to see a complete reversal of our economic and social fortunes.

My belief is that opposed to a Blue Boom we are likely to see more a Blue Honeymoon followed by a return to some tough times. I detail why below.

The Mood of a Nation

Demonstrated on election night was that as a nation there is a real mood for change, particularly from the agricultural and business sector. There is a hope that there will be some unwinding of legislation and taxes (bright line, interest deductibility, top tax rates, three waters etc.) that will return business confidence and economic growth.

With most people I speak to there is a small amount of euphoria and a large amount of relief with the election result. There have also been a number of people watching and waiting on the election result before making those investment decisions, now with some more certainty willing to take that leap.

Markets are really funny things. Perfect market theory suggests they are rational, however, as I think we all know, a lot of the market is carried by the mood of the participants and the ebullience a number of people are feeling at the moment is likely to flow through to the behaviour and decisions of the people in the short term. That can only be positively influenced with an El Nino summer after the cold and wet winter we have all had giving everyone a good dose of vitamin D to go with that positivity. We are already starting to see the results for this with the most recent ANZ Business Confidence Survey showing a 21 point jump to +23 the highest it has been since 2017.

Like any drug, however, this mood enhancer will wear off. The morning after as a nation wakes up sober they may look around and realise that there weren’t really any quick fixes. But before we wake up, let’s take a look at the positives from National.

Tax Changes

The two major talking points relative to property centre on tax rules. National plan to wind back the bright line tax back to 2 years and generally I think this is a good thing. It will increase the liquidity in the property market with people less cautious about selling down properties earlier and more willing to buy existing over new builds. There are plenty of people at the moment holding off selling, despite the high interest rates, as they don’t want to pay the tax. These aren’t properties that were bought 2 years ago but rather that bought 5 – 10 years ago and have seen significant house price growth. Eliminating this will also put further funds in these vendors pockets allowing them to re-invest that in the property market (new stock) or other opportunities.

The second, and perhaps greater impacting tax, is bringing back interest tax deductibility. Bringing this back will have a material impact on many property investors. Currently there are numerous property investors who will be facing large tax bills with already negative cash flows due to elevated interest rates. Whilst some may believe this is a good thing that should encourage those suffering to shift on these properties at lower prices, it does raise the issue of discouraging people to invest in property as there is a much greater expense added. A lack of investment will not solve the housing problem. Also, any direct cost to a business should be deductible and arbitrarily eliminating the ability to do so on the major expense for a single business segment does not ring well.

Again, this will also add some liquidity to the market making property more affordable for investors (less tax payable). As above, this also means more money in private pockets which can fuel economic growth.

There is also some relief around the current tax brackets with the initial stepped brackets each increasing in line with recent inflation giving some small tax relief to the average New Zealander which is a good thing. Given how much wage inflation has been in place over the last few years, even the last decade, the government has effectively been taxing the populace more heavily just by maintaining these. The first 3 tax brackets (up to $70k) have been in place since 2010. The minimum wage in 2010 was $12.75 which equates to $26,520.00 annually (based on an average 40 hour work week). This is now $22.70 or $47,216.00 annually (almost doubled!). The cost of living has gone up a lot since then (remember those $3 coffees?) and therefore the quality of living hasn’t really increased – tax revenues have though. Increasing these brackets will again release more money to individuals and help with some of the living costs.

Lastly, linked to tax is the removal of the ban on overseas buyers to allow international buyers to purchase properties >$2M. There is a tax linked to these which the revenues have been pegged to allow for tax cuts and spending elsewhere. The lift of the ban, however, is a good thing. It will again bring greater liquidity to that market and also attract capital and people from overseas. It is unlikely it will have a big impact on housing affordability as that is really at the lower end of the market. The flow of capital and investment in NZ from overseas is, however, a good thing and will be a boon for the NZ economy as will the increase in tax revenue.

There are plenty of other minor changes within National and Act’s tax policies and these have similar intents in releasing more capital to Kiwi’s. All of these will improve the mood of the business sector and bring about further confidence and likely spending.

Less Wasteful Spending

I recently read an article which detailed some of the spending we have seen over recent years. It opened by discussing the spending now vs when the Labour government was elected back in 2017, it has increased $63 Billion Dollars per annum which is approx. 83%. I found that quite striking.

Both National and Act campaigned largely on reducing the size of government and government spending. There are many thoughts around this and there was a significant amount of support on the other side of the aisle here as well. Without getting into the politics of where those spending cuts might come, the cut in spending should see a fall in inflationary pressures.

Inflation has undoubtedly been a weight on the economy and business and consumer confidence for the last 24 months. Anyone (apart from Luxon) that regularly buys the groceries will find themselves checking prices, looking for discounts and likely eating less. Decisions on investments are falling behind decisions about buying the morning coffee, the weekly Friday night takeaways or even the summer holiday. The sooner we can get this under control (and perhaps see some prices fall….) the better.

Reducing budget deficits and spending will help with this.

Increasing Productivity

This has been a softer line of commentary from the political parties but certainly something both National and Act have campaigned on. You will have heard Christopher Luxon repeatedly mention the words ‘getting kiwis back to work’ and seen the comments about how many more people are on the job seeker benefit. I recall seeing Christopher Luxon speak to an audience of mortgage advisers in 2022 and one of the key themes of his discussion was around productivity.

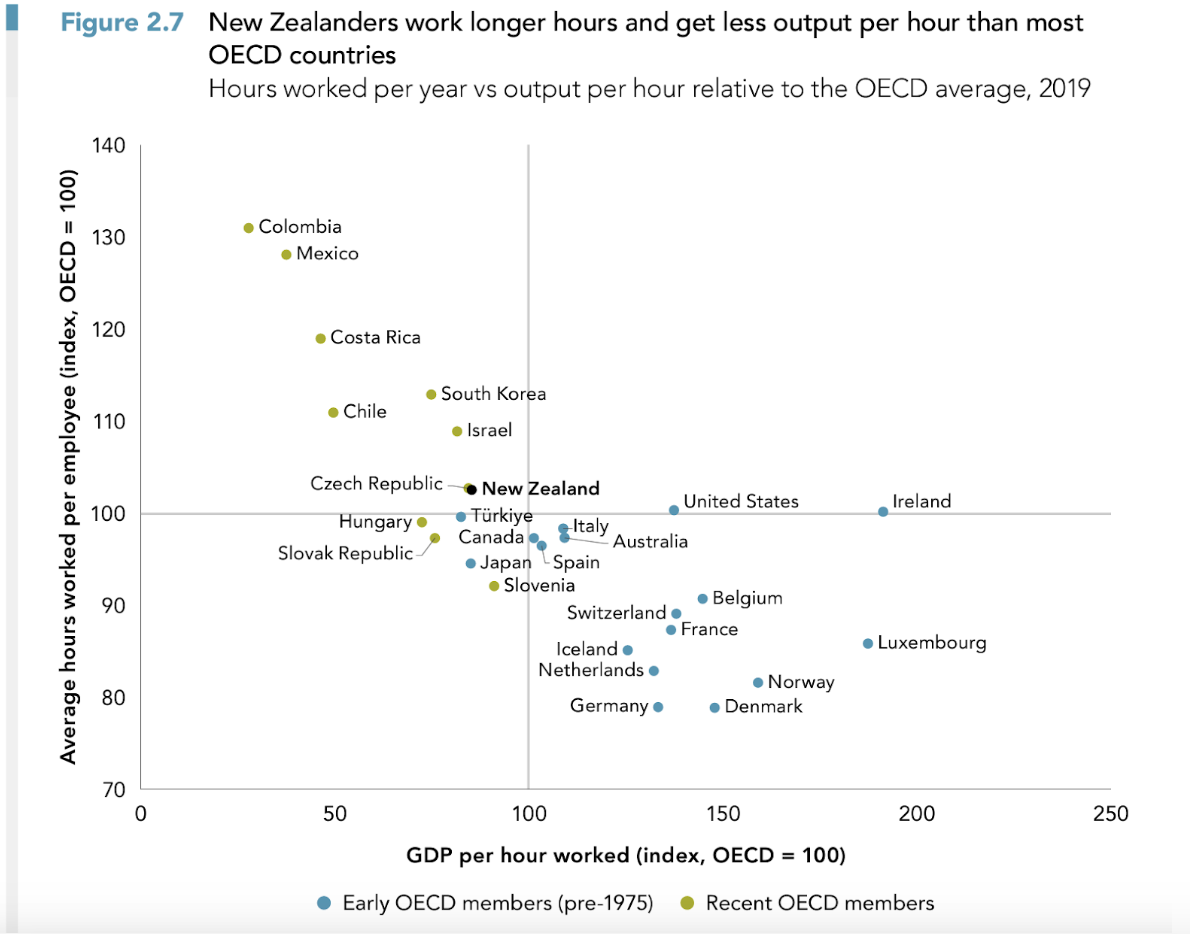

New Zealand are currently ranked exceptionally poorly globally in regards to productivity.

Page 25 - Productivity Report

Per the above, Kiwi’s work many more hours for less of an outcome than most of the OECD countries. Getting more Kiwi’s back into work and increasing the nations output will help greatly with productivity. In doing so it should result in greater wealth as a nation and better living standards for all.

If the incoming government can manage to improve us here then it will be a great boon to us all and improve things. National has pledged to get more kiwi’s working and encourage them back into the workforce. This will likely involve some cuts to beneficiaries to incentivise this, but the bet is it will drive more back to productive work which will increase NZ’s output. This is great if we can make it work as basic supply and demand dictates that with more supply (output) and equivalent demand we should see prices fall which helps with price inflation and therefore living standards. Also, if we have more to sell (higher output) then as a nation we should be wealthier.

So with all these positives, surely it will be a Blue Boom right?!

Wrong.

Learn more about why, in part 2.

Please read our Disclaimer Statement for more information.