Despite all of National's positive action promises outlined in part 1, there are still some really big hurdles to get over before we can expect another boom.

Let’s work through a few of these.

Interest Rates

Following inflation we have seen the RBNZ try to take a rather hard line to try and bring it back under control. We have lifted interest rates earlier and quicker than most of the Western world. Not all will agree we did this sharp and fast enough and a lot think we have gone too far.

Either way, it does appear that rates at this level or higher are going to be sticky. The commentary from the RBNZ is that rates will remain ‘higher for longer’ which is not really welcome news to anyone with a mortgage but good for savers.

Inflation, whilst cooling, is still running well above the desired range for the RBNZ and not really showing any signs of slowing down. The Reserve Bank is likely to keep rates high until it is well under control and this means sitting at an elevated level for a while longer. This may change rapidly if there is a reckoning in the debt markets and we might see one with arrears continuing to climb, albeit I am not sure we will see that any time soon.

High interest rates will keep demand for debt dampened which directly impacts spending and asset prices meaning the market is likely to be softer for a little while.

NZ Debt Levels

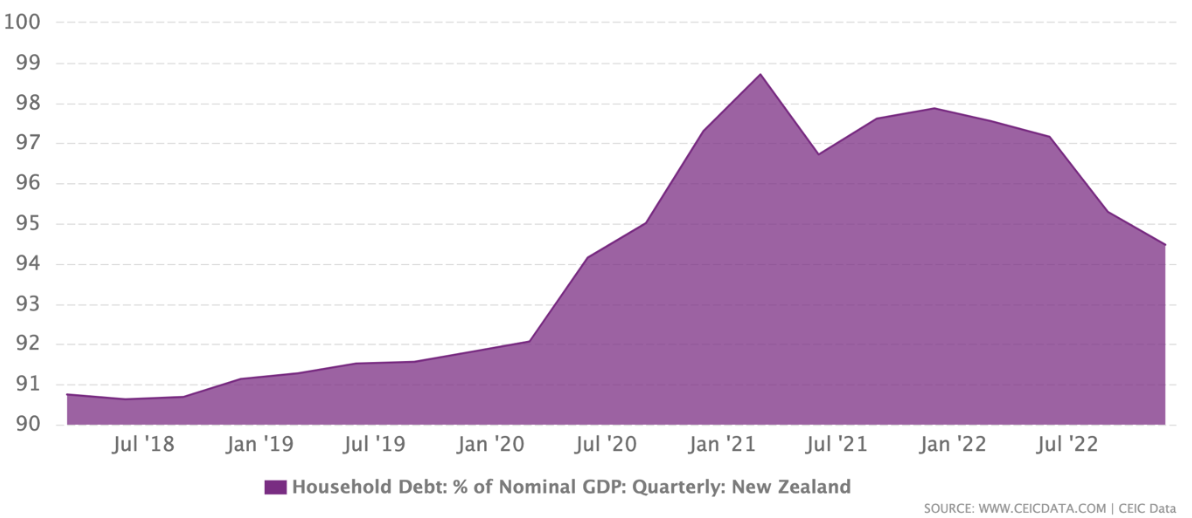

As Kiwi’s we continue to have an extraordinary high level of household debt currently sitting around 94.5% of National GDP. That places us 10th (highest) out of 91 countries on a CEIC survey.

Debt, whilst a great tool when used right, is also something that can be burdensome on economic performance as most of us will be realising at the moments with the elevated interest rates. Unwinding this big boom we have had in debt in the last 4 years will take some time to accomplish and likely continue to dampen growth and spending as funds are applied to debt servicing and reduction.

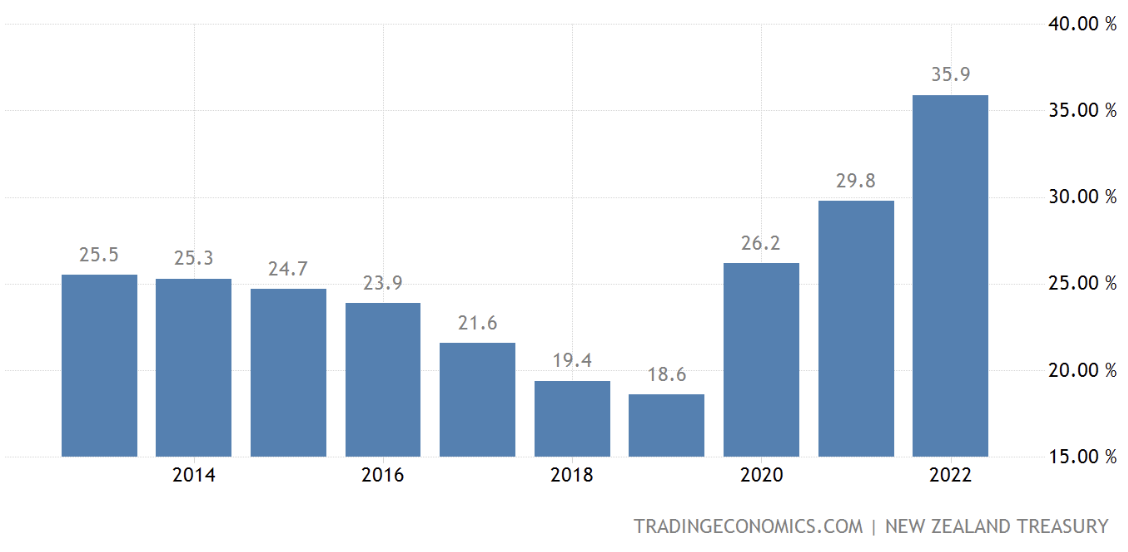

This above is just household debt, as a nation we are also heavily indebted as are a lot of western countries. As of today the NZ government has approx. $155bn of debt which is approx. 36% of GDP (see below).

This is something else that will take time to unwind and will have a drag on the governments ability to spend and support the nation through tougher economic times as interest payments consume tax revenues.

Further, fortunately we have indemnified the RBNZ from any losses to encourage them to wilfully buy government bonds on issue in recent years.... a wonderful thing... This has already cost the taxpayer north of $9bn and could climb if rates rise further.

Global Uncertainty

On top of all the above there is a healthy dose of global uncertainty out there. We have an upcoming election in America that is set to cause some real fractious behaviour. Further, they continue to print money like there is no tomorrow with their debts plowing through $33 TRILLION earlier in the month adding a further ~$500bn in just over 2 weeks. I am not sure when the music will stop over there, but there can’t be all that many seats left.

There are also two rather large global conflicts that will continue to occupy the minds of a lot of us and divert time, money and resource away from positive global actions. TThe battle in Gaza is also causing conflict in many other nations away from the fighting as people supporting each side are clashing showing how divisive the conflict is.

There is continued political uncertainty in the UK with high inflation, poverty and a threat of another early exit for the government.

Argentina have inflation topping 138% and had a split vote in their recent election. There are discussions about them doing away with the Peso and moving to the US Dollar which would be a huge undertaking.

All of these things and more will drag on business and consumer confidence.

Patience

Overall, while we might be ‘back on track’ as National and Christopher Luxon have claimed, the journey is going to take time. There will be some quick wins to get on the board and likely will be a snap positive reaction from the agricultural and business community who supported national in force. Long term, however, there are many items that need to be addressed and it is going to be a slog to manage some of them.

NZ as with a lot of the western world will need to deleverage both as a nationally and within our households. We are likely in a recession and still need to get to grips with continued inflation and the vast increase in the cost of living.

Beyond this, the incoming government needs time with their feet under the desk to enact their policies and decisions. They may also need some support from across the aisle possibly further slowing things down.

For these reasons, whilst I believe we are going to see some positivity in the near term, I don’t expect the curve to turn and remain steeply upward. Expect some more hobbling about with ups and downs before we properly find our footing to go again. Patience is a virtue.

As always, if you are after any advice to help out through this period sing out!

Cheers,

Ben Pauley

Please read our Disclaimer Statement for more information.