Welcome to the New Year!

Hopefully everyone has managed some time off and much needed R&R. It was a turbulent year last year with the big election and continued tightening in the economy.

As we look forward to a New Year we wanted to share some of our expectations and predictions for the economic and property market and how that might affect you. We will cover off interest rates, property prices and general economic expectations.

Interest Rates

Firstly, Interest Rates. This is a topic that has been on everyone’s mind for some time now. When we started Lateral Partners in 2020 we saw some of the lowest interest rates NZ has ever experienced with the 5 year fixed rates on residential lending dropping as low as 2.99% in 2021. Since then, rates have been rising steadily through to the tail end of last year in an effort to combat inflation with the RBNZ setting the pace of rises globally.

The rhetoric from the RBNZ started to soften towards the end of last year and we are now seeing some (small) drops in the longer end of the rate curve most recently seeing the 2 and 3 year fixed rates fall back under 7%. The SWAP rates have fallen dramatically and it does seem that inflation has tempered, albeit still well above target rates (5.6% p.a. per the September 23 data).

We are yet to see any rate cuts from the RBNZ with the OCR still sitting at 5.5% (interestingly still below CPI) but have seen a pause on raises. What is intriguing to see is the initial reporting on the Dec quarter and particularly Christmas trading for retailers which was materially weaker than expected. GDP fell 0.3% in the September Quarter and indications are that we could see another reduction in the December Quarter confirming that NZ has entered a recession.

Here at Lateral we have been sure of seeing rate cuts for a while now. Initially we had thought these would start in the back half of 2023, but missed that mark. Our belief is that between inflation and the vast increase in debts over the last few years coupled with the rapid rise in interest rates, consumers and businesses will struggle to make ends meet. This will result in a significant tightening of their belts and likely some mortgagee sales. National has also pledged to cut spending significantly which will continue to put pressure downward on the economy (not a bad thing as we cannot continue to run significant government deficits). We therefore remain steadfast that we will see some rate cuts this year to relieve some pressure and spur some economic growth.

What that might mean for inflation is a story for another day.

House Prices

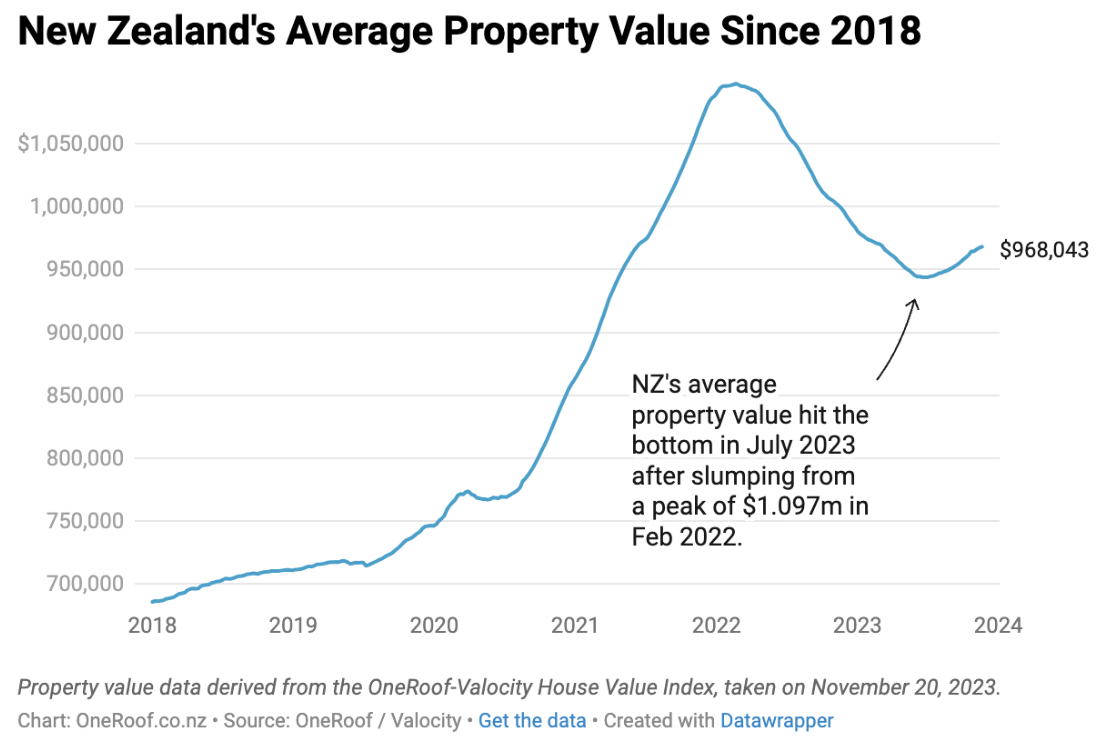

New Zealand has seen some falling or stagnant house prices over the last 18 months or so, tied tightly to interest rates which dampened activity in the property market following record increases.

Per the chart above, it appears the property market bottomed out in July last year climbing steadily since then.

Each major bank in New Zealand is expecting house prices to climb in 2024 and we tend to share that belief. There is a wide range of expectations with Westpac expecting them to climb as much as 7.7% and ANZ on the lower end at 2.3%. Where they might end up, we are not sure, but evidence would suggest they will climb. The primary drivers that we see are simply interest rates and migration.

As we spoke about above, we expect interest rates to fall over the next 12 months. That is going to ease some of the debt burden of existing borrowers as well as increase the capacity for new buyers to take on debt allowing them to enter the market with that increased activity driving prices upward.

The big kicker, however, is the Net Migration for NZ. Net Migration as at October 2023 sat at 128,900 people, absolutely smashing previous records. The previous peak (looking as far back as 2001) sat at 91,680 in March 2020 (Covid surge) with the previous 7 years averaging about 50,000. That means that current Net Migration is sitting at about 260% of normal levels. We would expect this to flatten out, however, remain well above what was previously considered the normal level.

Adding 130,000 people is going to drive a huge need for more housing stock and increase pressure on an already widely accepted housing shortage. This should have upward pressure on rents and house prices, particularly considering we have seen a downward trend in consents and home delivery over the last 18 months with the softening in the market.

Beyond this, there are other measures that the new government is pursuing such as the reduction in the Bright Line test, reintroduction of interest tax deductibility and housing delivery targets (reduction of reliance on Kainga Ora) that should all spur some house price activity.

With this all in mind, we expect house prices to rise generally over the next 12 months focussed primarily on the main city centres. How much, well I am not sure we are quite qualified for that punt.

General Economic Expectations

With interest rates falling and house prices rising you would be safe to assume that things are going to look a little rosy on the horizon. However, at Lateral we are not so sure. With the fall in interest rates, as we expressed above, we expect to be in a response to weaker economic conditions. Inflation and the surge in costs of debt (a number of people still to refix onto significantly higher interest rates) will continue to have downward pressure on the economic activity.

This is coupled with an effort to better balance the books from the new government which will see a fall in fiscal activity from the government and thus some economic activity. A lot of this is needed but much like trying to find your footing after stepping into a row boat it may take a few moments before things stabilize and we can push on.

Overall we expect a three key things to come about in the next 12 months;

- GDP to fall and NZ to enter into and remain in a recession for 2 – 3 quarters (through to June / Sept). It may be shallow, however, we do not expect to see economic growth in the first 2 quarters of the new year.

- Unemployment to rise. With downward economic pressure, cutting in government spending and continued belt tightening we expect to see unemployment to rise in the first half of the year. Unemployment began to rise slightly in the second half of last year, however, we expect this to climb more steeply in the following 6 months. Don’t be surprised if unemployment goes up by 50%+ in the following year (to 5 – 6%).

- Increasing distressed and mortgagee sales. Towards the end of last year we began to see more heavily distressed borrowers with action taken from their lenders. These primarily sat in the more commercial space, however, we did see some more traditional residential borrowers. We would expect this activity will continue to rise in the near future with many needing to move on property quickly below their price expectations.

So not all roses and lollipops unfortunately, but, hopefully a year in which we can reset and position ourselves for some prosperous economic growth in the future.

So there you have it, falling interest rates, rising house prices and some economic uncertainty. Overall, we think 2024 may be a tough year for many. This will all, however, provide some opportunity (as it always does) and some will do well. What is crucial is that you get good advice over this period and make informed decisions.

As always, if you have any questions or concerns, don’t hesitate to get in contact with us.

Please read our Disclaimer Statement for more information.