We do love a metaphor in New Zealand, a colloquial explanation or charming title for otherwise astonishingly normal aspects of human life. The property market, whilst yes, very normal, is something that requires a deeper dive into its nuances if one is to make their way to “the top of the ladder”. Assuming you have the concentration to get to the end of this collection of comments, my goal is to leave you feeling prepared for the next step, aware of your current position and the corresponding challenges you face, and equipped to make the most out of the rather unique market we are in.

Owning property has for a very long time been a staple of not only the culture in New Zealand, but the psyche of New Zealanders. The pressures of home ownership are everywhere and “the kiwi dream” is still a very unrealistic image of a quarter acre section, picket fence and not one… but two lawns (that’s front and back for those a little confused by that one). Whilst that is all well and good as a dream, the factors involved in getting there are slightly alarming. Location is obviously a factor to consider, as you’re far more likely to find a larger section and bigger property in Te Awamutu than you are in central Auckland, a fact that I’m sure has come as a comprehensive shock to you. With that in mind I'd like to reiterate that the percentages are the key in most of my calculations, and if the numbers used seem unrelatable feel free to scale as you see fit.

Can I use my house to buy an investment?

Yes! This is one of the more common ways New Zealanders purchase investment properties and is a way to avoid any cash deposit if there is sufficient equity in your home. This, however, is the big questions and one of the larger struggles in the current market, where house values are not what they were.

There is a key difference between equity and usable equity.

They do sound similar, but they have very important differences when looking to borrow against your home. Equity is difference between your current loan balance, and your current house value. On the day you buy your first house, it is the cash that you put in as deposit, but from that day forward it is no longer considered a deposit. Each month as you pay off your loan a little bit, and your house goes up (or down) in value, your equity changes. Usable equity is the idea of how much your bank will lend you against your house, if you have a $1m house, a $700k loan, this is $300k equity, but the bank won’t lend you that $300k as that would leave them overly exposed and against their equity requirements. In this situation you will be able to borrow only $100k of that equity.

The bank doesn't care what you paid for your house.

Obviously if you purchased the property yesterday, they aren’t going to turn around and tell you they don’t care anymore... but it definitely needs to be addressed that if you purchased your home 2 years ago for $800,000, chances are it is worth less today. When assessing a loan application, a bank will always want an up-to-date valuation, and what they lent you 2 years ago to buy the house is now assessed against the current value. This works in your favour when values increase (capital gains) however in the price decreasing environment we are in, having the tough conversations with clients to explain the inverse affect is becoming more prevalent (and surprisingly shocking to people).

The Bank does want a 20% deposit at the end of the day.

Now I know what you’re going to say, “purchasing a new build means on 10%” or “I got it through with less for my first home” ... and that is absolutely true, and a huge part of the market in New Zealand as the reserve bank has made rules to help Kiwi’s into their first homes. That doesn’t factor in the fact that these are in fact rule exceptions, and not changes to the rules. Standard reserve bank requirements for home ownership are 80% bank lending against your home. So, if you purchased with only 10% deposit, you’re already starting behind the 8 ball. Whilst not the end of the world, and a great way to start, you have a longer road back to borrowing more money as you won’t be able to borrow 90% again, this was a one-off exception to help you buy.

Investment properties require a higher deposit than your owner-occupied home.

Standard bank requirements for an investment property purchase are that they will only lend you 65% of the purchase price, meaning you will need to stump up 35% of the price in cash or equity.

Paying off your loan doesn’t increase equity as fast as you would think.

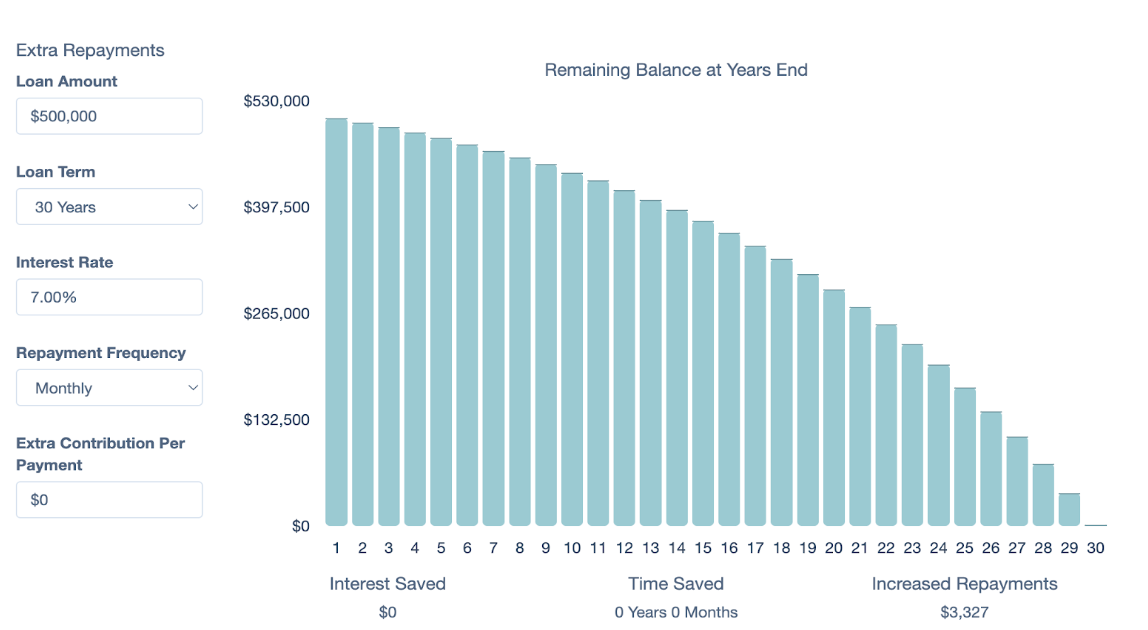

This may come as a surprise to most, but loans don’t decrease at the same amount each year, and the first repayments are considerably more interest to the bank, than principal off your loan. The graph below shows the projected loan balance over a standard 30 year term. You will see that the difference between day 1 and day 365 of your loan is minimal (paying off $5,079 in 12 months) whereas between year 20 and 21 the difference is much higher (paying off $20,513 in 12 months).

So as you pay off your loan using standard minimum repayments, your loan balance isn’t decreasing with any severity.

This is the benefit to extra repayments and offset facilities.

These are explained in my other blog linked HERE, which discusses how these loan tricks are used to reduce your loan principal faster, and how your extra cash is best used to maximise your future equity.

There are still equity exceptions for your second home.

As mentioned above, buying with less than the standard deposit is not impossible and there are exceptions to this rule. That being said, you will always be working towards the minimum equity requirement of 65% before you can look for further lending at that bank.

This is where separating your loan portfolio has its benefits.

As these exceptions don’t carry over between two different lenders, and there could be benefits to splitting up investment properties and owner occupied to maximise your borrowing capacity and ensure you’re using the equity you have to its maximum potential.

All this comes together to paint a pretty grim picture in the current environment. House values decreasing over the last few years have meant that having usable equity in an existing property portfolio is not as easy to come by as it used to be. If you are unsure whether you have equity, if your loans are suited to increase or maximise equity, or have any uncertainties that my rambling has raised.

Do reach out to your mortgage broker to explain further, it’s what we do.

Please read our Disclaimer Statement for more information.